One of the more significant barriers that online sellers initially had to work through many years ago was the matter of accepting payments. When ecommerce was relatively new, many consumers were apprehensive about providing their personal financial data online.

Over the years, online payment processing solutions have become increasingly secure. They’re also faster and easier for shoppers to use from a wide range of connected devices.

With the percentage of retail sales online growing, the impact of innovations in ecommerce payments has been irrefutably substantial. However, there’s still ample room to improve.

Both ecommerce businesses and online consumers are benefiting from developing trends for ecommerce payments, with access to new payment solutions and checkout options.

In order to make savvy decisions related to your store’s operations and growth, you will need to stay on top of the latest worldwide developments.

Here are some of the noteworthy trends that are likely to affect the global future of ecommerce and how online stores manage payments for this year and beyond!

Table of contents

- 1. Use of mobile devices to shop and pay for purchases online

- 2. One‑click and saved payment methods

- 3. Global focus on data privacy

- 4. More businesses using a subscription model

- 5. Increase in cross-border shopping

- 6. AI and machine learning in fraud detection

- 7. Increased use of digital wallets as payment methods

- 8. Cryptocurrency acceptance

- 9. Buy now, pay later (BNPL) expansion

- 10. Sustainability in payment processing

- 11. Voice and AI-driven payments

- 12. Pay by bank

- 13. Biometric payments

- Next steps for e-tailers

1. Use of mobile devices to shop and pay for purchases online

Do you have a firm understanding regarding from which kinds of devices your customers are making their purchases?

There’s a good chance that many of them are shopping from a mobile device!

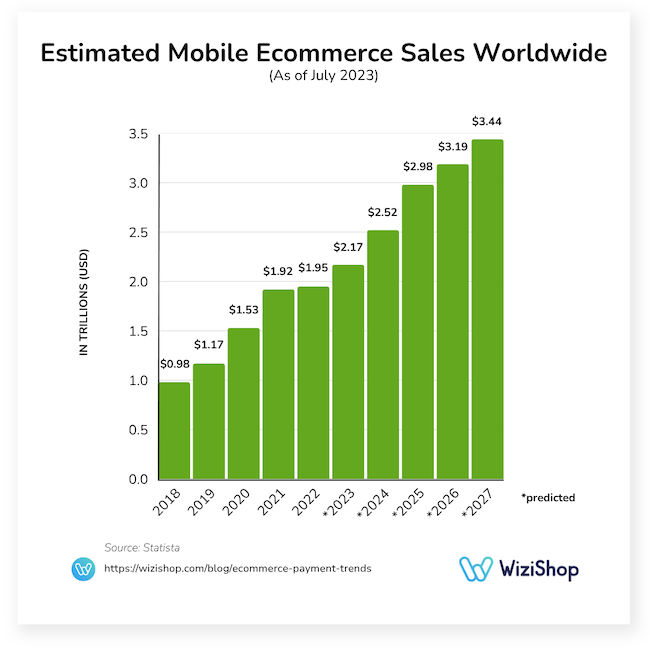

In 2023, global mobile ecommerce sales hit nearly $2.2 trillion, accounting for 60% of total global ecommerce sales.

Statista

There are a few reasons why mobile commerce is becoming increasingly popular. For instance, consumers have grown more confident in the security of online transactions.

This is particularly true when the transactions are with known and trusted businesses. Security badges on shopping cart pages can help instill confidence in online consumers.

Another reason for increased mobile transactions is that websites and apps have streamlined checkout processes that are easy to complete on a device with a small screen.

In addition, there are advanced ecommerce payment gateway solutions available that allow for more payment methods and make the processes safer, faster, and easier from any device.

For example, consumers may only need to log in to their PayPal accounts to make payments and complete mobile purchases rather than manually input credit card information.

Mobile commerce is only expected to grow, so your store should be positioned to deliver an excellent experience through mobile apps and browsers and not miss out on big opportunities to increase sales via mobile shoppers.

The table below shows the estimated share of total global ecommerce sales coming from mobile commerce from 2018 to 2027:

| Year | Mobile commerce's estimated share of total ecommerce sales |

|---|---|

| 2018 | 56% |

| 2019 | 57% |

| 2020 | 57% |

| 2021 | 58% |

| 2022 | 59% |

| 2023 | 60% |

| 2024 | 60% |

| 2025 | 61% |

| 2026 | 62% |

| 2027 | 62% |

Source: Statista

2. One‑click and saved payment methods

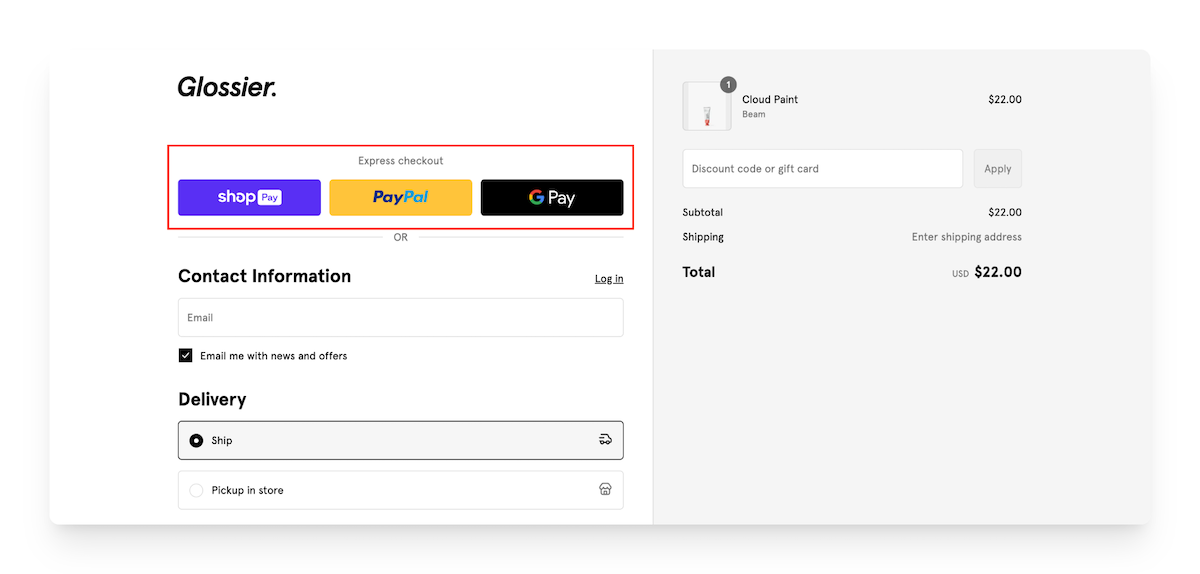

Another way that brands are offering shoppers additional convenience when buying on the internet is through one-click and saved payment methods, which allow customers to store their payment details securely for faster, simplified future purchases.

Once a user saves their card or uses a digital wallet like Apple Pay or Google Pay, they can complete transactions with a single click, bypassing lengthy checkout forms.

Glossier’s one-click express checkout

This tactic is particularly valuable for repeat shoppers, subscription services, and impulse purchases, where speed is essential.

One-click payments significantly reduce cart abandonment, improve conversion rates, and encourage customer loyalty by making it easier for shoppers to return and buy again. This method also supports upselling and faster reordering in just a few taps!

By minimizing the effort required to complete a purchase, one-click and saved-payment methods help e-tailers capitalize on intent, enhancing both the user experience and overall sales performance.

3. Global focus on data privacy

With the growing number of ecommerce transactions, data privacy and online security are increasingly important worldwide, regardless of niche or market.

86% of U.S. consumers state that data privacy is a growing concern.

KPMG

If you haven’t reviewed your website’s compliance with data privacy standards and the Payment Card Industry Data Security Standard (PCI DSS), now’s the time to do so.

Here are a few key data privacy regulations you may need to consider, depending on your business’s location.

General Data Protection Regulation (GDPR)

The General Data Protection Regulation (GDPR) is a European Union law that governs how organizations collect, use, store, and protect personal data of EU citizens.

Enforced since May 2018, it grants individuals rights over their data, including access, correction, deletion, and portability.

GDPR applies to any business handling EU data, regardless of location, and mandates transparency, data minimization, and security.

Non-compliance can result in significant fines of up to €20 million or 4% of global annual turnover.

Second Payment Services Directive (PSD2)

The PSD2 has set up standardized regulations for payment and data security throughout the European Union and in other countries in the area.

Under this directive, all providers who process payments for consumers in the region must remain in compliance with the established standards.

California Consumer Privacy Act (CCPA)

This is a new regulation that started impacting Californians in 2020.

It offers some of the same protections as the GDPPA. For example, it gives consumers the right to prevent the sale of their personal information and to know when their data is being obtained.

These are only a few of the many regulations that affect ecommerce.

Staying updated about new and changing regulations is a heavy burden for some ecommerce businesses. All-in-one payment processors are assuming this responsibility in the services that they provide.

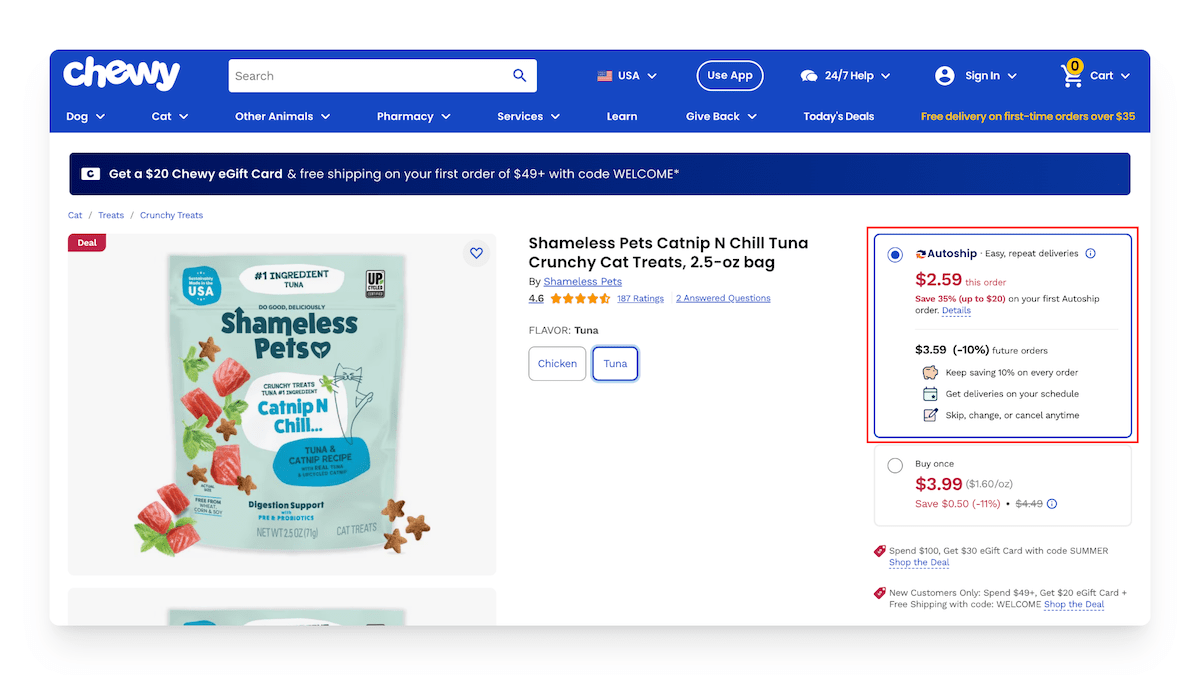

4. More businesses using a subscription model

Subscriptions have traditionally been used to meet a consumer’s recurring need for the same service or item. Ecommerce businesses are now incorporating subscriptions or autoship options into their business models more frequently.

Ability to select “Autoship” when purchasing products on the Chewy website

The actual subscription model will vary based on the business’s offerings and customer base. However, subscriptions enable companies to maintain flexible offerings to meet their customers’ needs and budgets.

Subscriptions offer profound benefits to businesses as well.

The nature of the traditional ecommerce business model requires companies to maintain a solid stream of online traffic to maintain steady revenue.

Furthermore, the store must have a healthy number of loyal customers, a high conversion rate, or a balance of both.

Through subscriptions, companies are able to maintain revenue even when online traffic slows.

Technology has facilitated the growing popularity of subscriptions in ecommerce.

Some payment processors have specific features that support managing and collecting subscription payments. This takes a heavy burden off of ecommerce businesses and boosts the benefits of subscriptions.

5. Increase in cross-border shopping

Many of the challenges associated with serving customers across international borders are overcome through access to modern technologies and services.

To sell products in another country successfully, businesses previously had to make currency conversions.

In addition, there was a need to monitor and comply with taxation regulations.

While these requirements remain in place, they can be addressed without hassle by modern ecommerce businesses through online payment processors and gateways.

The ability to expand your store’s reach across borders can have a profound impact on your bottom line and growth.

The value of the cross-border online shopping market was approximately $785 billion in 2021, and this figure is predicted to reach $7.9 trillion by 2030.

Statista

Ecommerce payment platforms handle the conversions and tax compliance on your behalf so that you can reap the benefits without the hassle.

6. AI and machine learning in fraud detection

As digital commerce continues to grow, so does the prevalence of cyber crime.

In 2024, the average cost of a data breach for companies soared to $4.88 million, representing a 10% rise compared to the previous year.

Thomson Reuters

Cybercriminals are constantly fine-tuning their efforts, and this means that ecommerce businesses must be at the top of their game in this area at all times.

Advanced AI and machine learning algorithms are revolutionizing fraud detection in ecommerce in numerous ways:

- Real-time threat detection: AI systems can continuously monitor traffic and user behavior to detect suspicious activity, such as account takeovers or unusual transaction patterns, allowing businesses to respond instantly to potential threats.

- Fraud prevention and risk scoring: Machine learning models analyze historical data to identify fraudulent transactions and assign risk scores to purchases. This helps flag high-risk orders before they’re processed, reducing chargebacks and losses.

- Automated security responses: AI can automate responses to common cyber threats—like blocking malicious IPs or triggering multi-factor authentication for high-risk logins—speeding up response time and reducing reliance on manual intervention.

For online merchants, this means reduced financial losses and fewer false positives that can block legitimate transactions, enhancing operational efficiency.

Shoppers benefit from increased security and a smoother buying experience, as AI-driven systems efficiently differentiate between genuine and suspicious activities.

This proactive approach reassures customers, fostering trust and loyalty, which are crucial for the long-term success of online businesses.

7. Increased use of digital wallets as payment methods

Digital wallets, also known as e-wallets, are electronic devices or online services that allow individuals to make electronic transactions.

This can include purchasing items online with a computer or using a smartphone to purchase something at a store. Examples of digital wallets include Apple Pay, Google Wallet, Samsung Pay, and PayPal.

This payment method has become a significant trend in ecommerce due to its convenience, security, and speed, offering a seamless checkout process by storing payment information securely and facilitating quick transactions.

In 2023, 53% of U.S. consumers used digital wallets more often than traditional payment methods.

Capital One Shopping

Online merchants should accommodate digital wallets to cater to consumer preferences, enhance the user experience, and reduce cart abandonment rates.

Offering digital wallet options can also attract a broader customer base, improve conversion rates, and provide robust security measures, which protect both the merchant and the customers from potential fraud.

8. Cryptocurrency acceptance

Cryptocurrency, or crypto, is a type of digital or virtual currency that uses cryptography for security, making it difficult to counterfeit.

These currencies are decentralized and typically operate on technology called blockchain, a distributed ledger enforced by a disparate network of computers. Examples include Bitcoin, Ethereum, and Litecoin.

In 2014, Overstock was one of the first major retailers to accept the cryptocurrency Bitcoin as a payment method.

Today, although you still can’t expect to be able to pay with cryptocurrency wherever you shop online, more and more ecommerce businesses are accepting cryptocurrencies as payment methods due to their growing mainstream acceptance and the appeal of lower transaction fees.

The number of identity-verified cryptocurrency users worldwide was 338 million in June 2022 and increased approximately 82.5% in two years, amounting to 617 million in June 2024.

Coolest Gadgets

Allowing for cryptocurrency payments lets you tap into a tech-savvy customer base that values privacy and transactional transparency.

Integrating cryptocurrency payments can also position your brand as innovative and forward-thinking, potentially increasing appeal to a broader, more diverse audience while ensuring transactions remain secure and private.

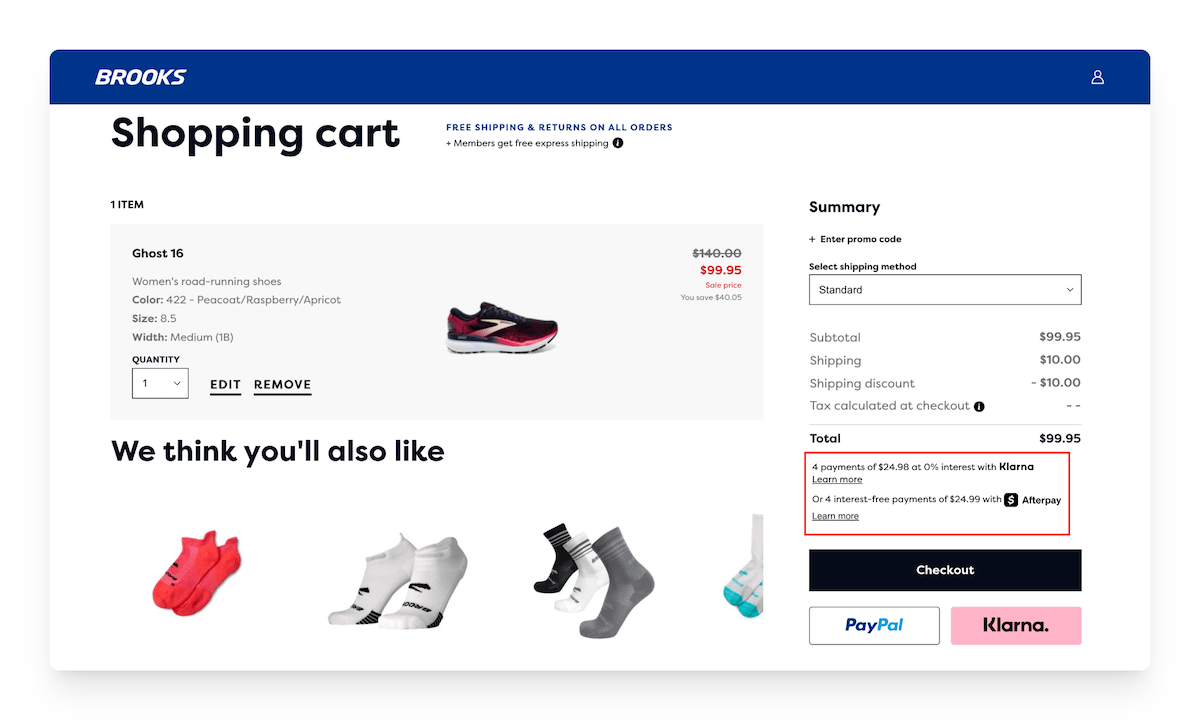

9. Buy now, pay later (BNPL) expansion

BNPL services like PayPal’s Pay in 4, Klarna, Afterpay, and Affirm are also expanding rapidly, providing customers with flexible payment plans, which are particularly attractive for larger purchases.

These services allow consumers to purchase goods immediately and defer payment through structured installments.

Klarna and Afterpay BNPL options available on the Brooks website

Unlike traditional credit, BNPL often comes with no interest if payments are made on time, and it’s typically facilitated through quick, online approval processes.

This payment method has become popular in ecommerce due to its flexibility, enabling customers to manage their finances more effectively and make larger purchases without immediate financial strain.

BNPL options can help enhance customer satisfaction and attract a wider audience, especially among younger shoppers who may prefer not to use traditional credit cards.

Offering BNPL can also boost conversion rates, increase average order values, and reduce cart abandonment by providing a more accessible way to finance purchases directly at the point of sale.

10. Sustainability in payment processing

As consumers increasingly prioritize environmental impact in their purchasing decisions, it’s not surprising that many e-tailers are looking for ways to improve sustainability when it comes to payment processing.

In a recent Ecommpay study, 94% of ecommerce merchants stated they were somewhat or strongly influenced by the sustainability values of payment providers when deciding which ones to use.

The Fintech Times

E-tailers can enhance sustainability in payment processing by adopting digital-only receipts, reducing paper waste, and choosing eco-conscious payment providers that use energy-efficient data centers.

Encouraging low-energy payment methods like mobile wallets and minimizing reliance on energy-intensive blockchain-based systems also helps. In addition, consolidating transactions and streamlining payment systems reduces server load and emissions.

Transparent reporting on payment-related carbon footprints can further promote accountability and support environmentally aware customer choices.

Online merchants should integrate sustainable payment options to align with the values of eco-conscious consumers, enhance brand image, and contribute to environmental conservation.

11. Voice and AI-driven payments

Voice and AI-driven payments involve using voice commands or artificial intelligence to complete transactions, typically through smart assistants like Amazon Alexa, Google Assistant, or Siri.

Smart devices for use with Amazon Alexa

Consumers can speak naturally to initiate purchases, check order statuses, or authorize payments, making shopping hands-free and highly convenient—especially on mobile devices and smart speakers.

These systems use natural language processing (NLP) and secure authentication, often combining voice recognition with device-based biometrics or PINs.

AI also enhances personalization by suggesting products, automating reorders, and predicting needs based on past behavior.

Integrating voice payments can improve customer engagement and tap into growing smart device usage.

To implement effectively, ensure your product catalog is voice-search optimized, invest in secure voice authentication, and start with simple transactions or reorders.

Testing and refining user flows is key. As adoption grows, voice and AI payments offer a future-forward way to increase loyalty and remove friction from checkout.

12. Pay by bank

For online shoppers who prefer to stay away from paying with credit cards and using BNPL services, direct bank payments are often the perfect solution.

Enter “Pay by bank”—a growing ecommerce payment trend enabled by open-banking and real-time account-to-account (A2A) payment systems.

Instead of entering card details, customers select “pay by bank” at checkout, authenticate directly with their bank via strong customer authentication, and funds are transferred immediately through systems like Europe’s SEPA Instant, India’s UPI, or the UK’s Faster Payments.

This payment method provides enhanced security, as customers authenticate with their bank under PSD2 SCA regimes—reducing fraud and chargeback risk.

Furthermore, merchants avoid credit/debit card fees, leading to considerable savings.

84.3% of users are very or extremely satisfied with pay-by-bank experiences.

PYMNTS

While this trend is seeing rapid global momentum, its pace depends on local infrastructure, regulation, and consumer trust.

13. Biometric payments

Biometric payments—using fingerprints, facial scans, palm recognition, voice, or even vein patterns—are rapidly gaining traction in ecommerce due to their convenience and security.

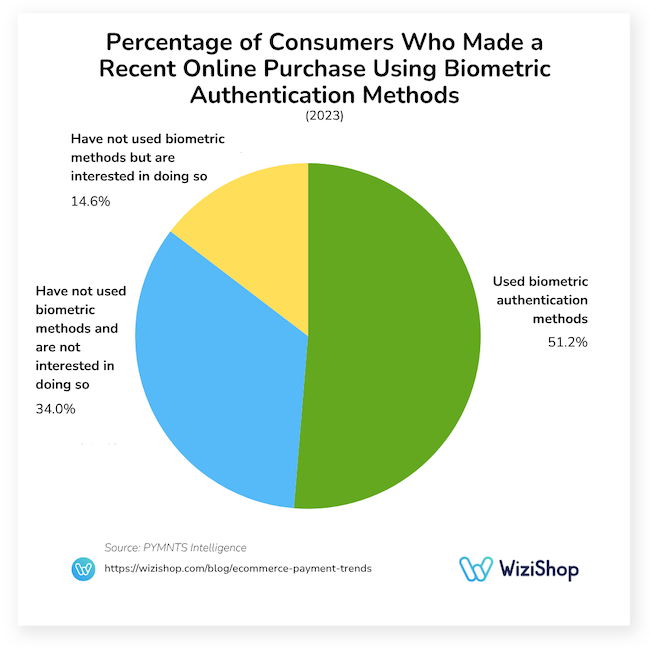

In a 2023 study done by PYMNTS Intelligence that interviewed shoppers who had completed a purchase online within the last 30 days, over half (51.2%) of respondents used biometric authentication methods.

Transactions are authenticated in seconds, eliminating PINs or passwords while offering frictionless checkout experiences that drive higher conversion rates.

In terms of which groups biometric payments are most likely to appeal to when paying for products or services on the internet, this method is most often used by younger shoppers, with 58% of consumers ages 18 to 24 having used biometric payments.

The following table details the share of consumers in each age group who have used biometric payments for online shopping:

| Age group | Share of consumers who have used biometric payments for online purchases |

|---|---|

| 18 to 24 | 58% |

| 25 to 40 | 55% |

| 41 to 56 | 24% |

| 57+ | Under 10% |

For businesses, benefits include reduced fraud, fewer chargebacks, lower administrative costs, and improved customer loyalty through personalized experiences.

However, the trend isn’t without challenges.

Privacy and data protection regulations, like GDPR and state-level biometric laws, mean companies must securely store or locally process sensitive biometric templates, imposing compliance burdens.

Technical limitations, such as false rejects or spoof attacks, and inconsistent interoperability across biometric systems also hinder seamless use.

Lastly, social acceptance varies: while younger users readily adopt biometrics, older demographics often remain skeptical due to health, accessibility, or privacy concerns.

Next steps for e-tailers

As an entrepreneur involved in web commerce, you may be wondering what the best options are when it comes to the payment solutions you should supply on your online store with all the different methods for making payments available on the market today.

When online shoppers click “Buy now” and get to the checkout stage, what methods will push them to pay and finalize the transaction?

The truth is there’s no one-size-fits-all solution that will work for e-merchants everywhere.

The preferred method of payment in ecommerce varies worldwide, but digital wallets are increasingly dominant. They offer convenience, security, and speed, making them highly popular in regions with strong mobile connectivity and technology adoption, such as Asia-Pacific and parts of Europe.

In the United States, credit cards and debit cards still hold substantial sway, but the widespread adoption of digital wallets and alternative payment methods like Buy Now, Pay Later (BNPL) schemes are shifting consumer preferences.

As preferred payment methods can be quite different depending on your location and the people in your target market, it’s essential for online merchants like yourself to monitor the trends in ecommerce payments and other aspects of digital technology.

To ensure that you’re offering the payment methods that are best for your customers as well as your business, start by auditing your current payment options. Prioritize flexible, secure, and localized methods.

If you aren’t already doing so, consider integrating BNPL and wallet options as well as leveraging AI-based fraud tools and tokenization. You might also think about exploring subscription models in your vertical.

When you understand the latest resources, services, and technologies for making payments in use today, you will be able to more strategically position your business to take advantage of them.

At the same time, you can remain attuned to customer expectations and concerns so that you can provide consistently great service to your customers.

Now that you know what the developing trends in ecommerce payments are, you can identify areas where your business has room for improvement and growth!